News Release

News ReleaseGame-Changing Tumor Freezing Technology Has The Potential To Offer Women First-Ever Minimally Invasive Alternative To Breast Lumpectomy Surgery

Benzinga

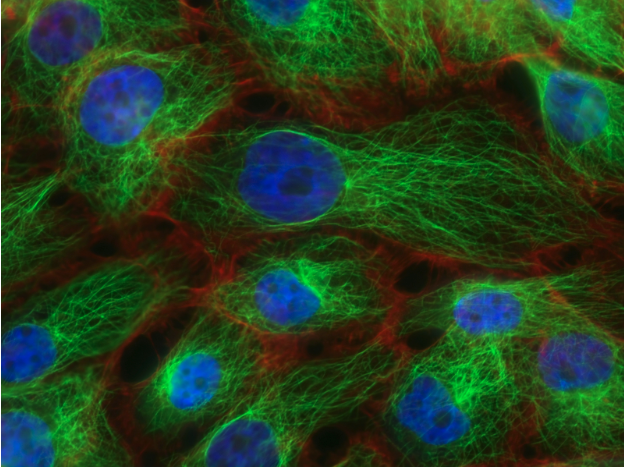

By Meg Flippin, Benzinga IceCure Medical Ltd. (NASDAQ: ICCM), which is set to submit results from the largest cryoablation study of its kind to the FDA, may set a new standard of care for early-stage breast cancer in women who elect not to have surgery. This could be a game-changer for the medical community and IceCure alike. When it comes to the early onset of breast cancer, the typical treatment protocol is for women to undergo a lumpectomy followed by chemotherapy, hormone or radiation therapy. The lumpectomy involves removing the tumor and some healthy tissue around it surgically in a hospital operating room. It requires heavy sedation, is often painful and has a long recovery time. While tens of thousands of lumpectomies are performed annually in the U.S., it is not a perfect solution. In about 20% of cases, a second surgical procedure known as a re-excision is required to get rid of lingering cancer cells. Some tumors are difficult to spot or feel which makes them hard to locate during the surgery and thus follow-up surgeries are often required. Re-excision can not only be costly, it adds to the recovery time and weighs on the patient’s mental health. Some women, concerned about their future, opt at that point for a mastectomy. Freezing Tumors May Be The Answer With about 280,000 women diagnosed with invasive breast cancer each year, and around 340,000 total cases, finding better alternatives is front and center for many healthcare providers, drug companies and biotechs including IceCure Medical Ltd. (NASDAQ: ICCM). IceCure is expanding the use of ProSense®, an advanced liquid-nitrogen-based cryoablation therapy for the treatment of tumors (benign and cancerous) by freezing, with the primary focus areas being breast, kidney, bone and lung cancer. Cryoablation is a potentially attractive option for treating tumors because it is minimally invasive and has little pain associated with it. Tumors can be seen clearly by using imaging modalities like ultrasound or computerized tomography (CT), accurately destroying diseased tissue within the tumor zone. Cryoablation reduces surgery-related complications, downtime for the patient and economic burden to the insurer and the medical provider, as well as reducing the need for secondary lumpectomy in breast cancer. IceCure likens its ProSense procedure for breast tumors to that of going to the dentist, with no scarring or general anesthesia required. Rather, IceCure relies on lidocaine used locally so there is no need to go to a hospital or stay overnight to recover, all of which reduces costs and speeds up recovery. Unlike lumpectomies, cryoablation does not involve the excision of breast tissue, thereby eliminating many of the adverse cosmetic effects of tumor excision as well. Some researchers have even called cryoablation the “ultimate esthetic solution for breast cancer” because it reduces the need for pre-emptive or corrective surgical procedures to maintain or restore breast volume, contour and symmetry. For all of those reasons, breast cancer cryoablation has emerged as a possible alternative to lumpectomy for early-stage breast cancer over the past decade. Promising Topline Results IceCure recently announced positive topline results from its ICE3 study, which it says is the largest controlled multicenter clinical trial ever performed in the U.S. for liquid nitrogen (LN2) based cryoablation of low-risk, early-stage malignant breast tumors, following the five-year follow-up evaluation of the ICE3 study's last patient. In the ICE3 study, 96.39% of patients (187 out of 194 patients) were local recurrence-free with no significant device-related adverse events or complications reported. Based on those topline results, the company said ProSense has the potential to be a safe and effective alternative to lumpectomy for early-stage breast cancer. The company says it is on track to submit the full data set and results to the U.S. Food and Drug Administration (FDA) for marketing clearance any day now, and Prosense is already approved for breast cancer in other territories like Europe. The breast cancer market size is significant, and was valued at $31.89 billion in 2022 and is forecast to hit $70.53 billion by 2030, growing at a CAGR of 10.43% over 2023-2030. The tumor ablation market is expected to reach $2.4 billion by 2028, growing at a CAGR of 13.2% from now until then. "We are very pleased with this topline outcome and believe these results demonstrate a highly favorable safety and efficacy profile that positions ProSense® as a desirable alternative to lumpectomy for early-stage breast cancer," said Eyal Shamir, Chief Executive Officer of IceCure. "While the FDA evaluates the data, we are optimistic its upcoming decision will give women in the U.S. the same access as those who are already benefiting from ProSense® in other countries,” he said. ProSense has regulatory approval in 15 countries for a broad range of indications including in Europe, Brazil, Canada and China. Incidents of breast cancer are increasing around the world, with many people facing invasive and time-consuming procedures. While lumpectomies will continue to be necessary sometimes, companies like IceCure may be giving patients an alternative way to fight this disease. With full data being submitted to the FDA any day now, if approved it could prove to be game-changing for IceCure and women across America diagnosed with early-stage breast cancer. Featured photo by National Cancer Institute on Unsplash. Benzinga is a leading financial media and data provider, known for delivering accurate, timely, and actionable financial information to empower investors and traders. This post contains sponsored content. This content is for informational purposes only and is not intended to be investing advice. Contact Details Benzinga +1 877-440-9464 info@benzinga.com Company Website http://www.benzinga.com

April 12, 2024 01:35 PM Eastern Daylight Time

Image